Would you like to make this site your homepage? It's fast and easy...

Yes, Please make this my home page!

To UCC or not to UCC?

Christians Against Zionism - April 2005

Hello everyone. For some time now, I have heard

continued ramblings about the applicability of the Uniform Commercial Code

here in Canada. I have tried to inform people obviously without much success,

that this U.S. law does not apply herein Canada and by attempting to use same,

you are simply accelerating the Americanization of this land. However, I have

waited until I received some further confirming information prior to sending

out this email, and which I have attached hereto.

My first point is this: if we want to be

Canadians, or at minimum, non Americans, why are people attempting to bring

United States laws here into Canada? Many people continually profess to be

anti-American yet repeatedly attempt to rely upon the UCC in their

quest for justice. This is simply a non sequitor.

Second. The UCC is, as you can see by

some attached excerpts from this law, a purely American law. It applies to

the U.S. and quite probably its offshore lands such as Puerto Rico.

It does not apply to Canada, which has our own analogous

legislation, the Bills of Exchange Act, and various provincial

legislation.

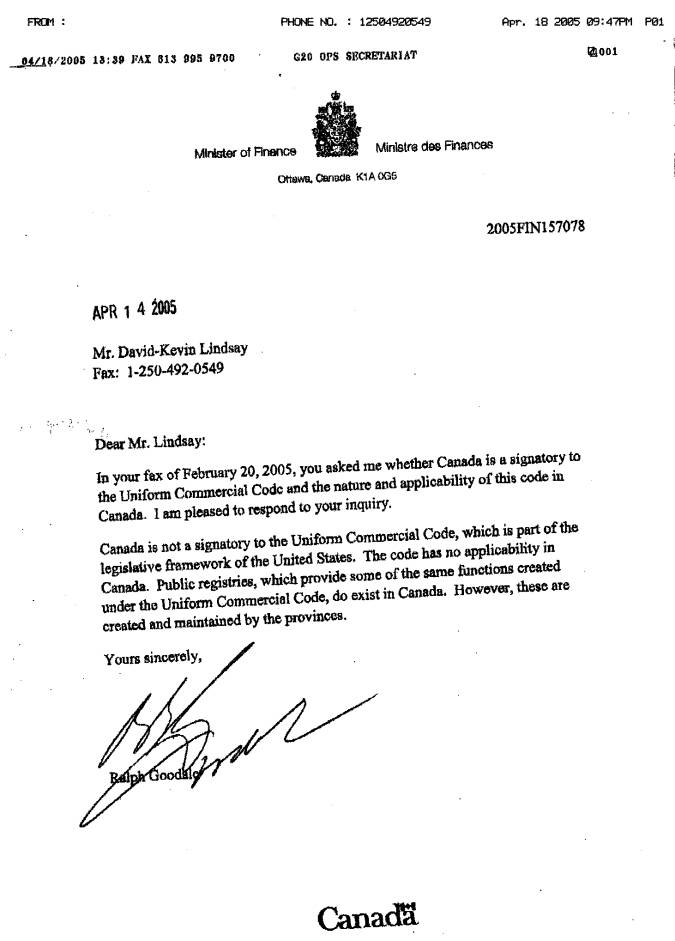

I have sent a letter to the Minister of Finance to

confirm my views. I have just received his response, which is attached

hereto. In no uncertain terms, the Minister makes it quite clear that Canada

is NOT a signatory to the UCC nor does the UCC have any

applicability here in Canada. I have quite frequently maintained, when trying

to obtain information, apply the principle, "let them do the work"!

In other words, instead of spending 100's of hours doing research, simply

write a letter to the appropriate person and let them do the work for you. In

this case, I let the Minister of Finance, Ralph Goodale do the work. This is

their job. On an issue such as this, with no immediate possibility of

exposure of criminal actions, I have no doubt in my mind that the Minister if

not committing a fraud and lying to me in his letter - nor do I see any such

lies ni his response.

If you are using the UCC, you are quoting

foreign law which has no applicability herein Canada. There are however, a

couple of exceptions. For eg., if I enter a contract with someone in the

U.S., the onus is upon us to determine which country's laws will apply should

a dispute arise. This must be specified expressly in the terms of the

contract. If it is not and a dispute arises, with each party to the contract

claiming their county's laws apply, if the claim is filed here in Canada, the

judge will have to look to the nature and terms of the contract to see which

country's laws should apply, pursuant to the terms and nature of the

contract. The possibility exists that although there is no express mention of

what country's laws apply, that there is, by reading the contract, an obvious

intention as to what country's laws apply. If there is no express mention as

to what country's laws apply and if the judge is unable by reading the

contract to see if there is an implied intention of what laws are going to

apply, then the judge is required to see what country's laws best apply to the

issue at hand. This procedure has been upheld by the SCC and is what is

followed by all lower courts. It certainly has some logic to it - not that I

am a fan or supporter of the SCC - only to show that this is how contracts are

interpreted here in Canada.

If the claim is filed in the U.S. this same

procedure is followed.

If two parties are both Canadian, no matter

whether they are man or woman, person or corporation, then Canadian laws apply

and you cannot, even consentually between both parties, choose to have the

Canadian courts or political establishment, invoke and apply foreign law to

Canadian contracts in Canada.

So if you are using the UCC,

notwithstanding any purported 'sucess' you may appear to be having, this law

does not apply and governments, banks etc are not bound by it. In the absence

of any reason for your adversary's failure to contest, you can only presume,

based upon their actions, they quite possibly they just don't want a hassle or

some other reason for their want of interest in your matter. No different for

eg in my case, CRA did not charge me notwithstanding that I have not filed

since 1996. This does not permit me to go publically claiming that I am

successful because CRA has not charged me. There was obviously other reasons,

which I am not aware of, why they did not take action sooner. Similary, there

could be an infinite number of reasons for any apparent success you may be

having - the UCC is not one of them.

My recommendation is QUIT USING THE UCC!

Find the Canadian equivalent to whatever section you are currently relying

upon and use Canadian law. Or be an American and go live in the United

States!!!

David-Kevin: Lindsay

---------------------------------------------------------------------------